Hi, My name is Sunil Chaudhary. I am an Insurance certified professional. Here in this post, I am going to detail what is insurance deductible and how it works.

All About Insurance Deductible – Must Know

What is Health Insurance Deductible Car Home Medical Bills FAQs

I would like to keep the post in questions and answers format so that many of your queries related to Insurance deductible gets answered.

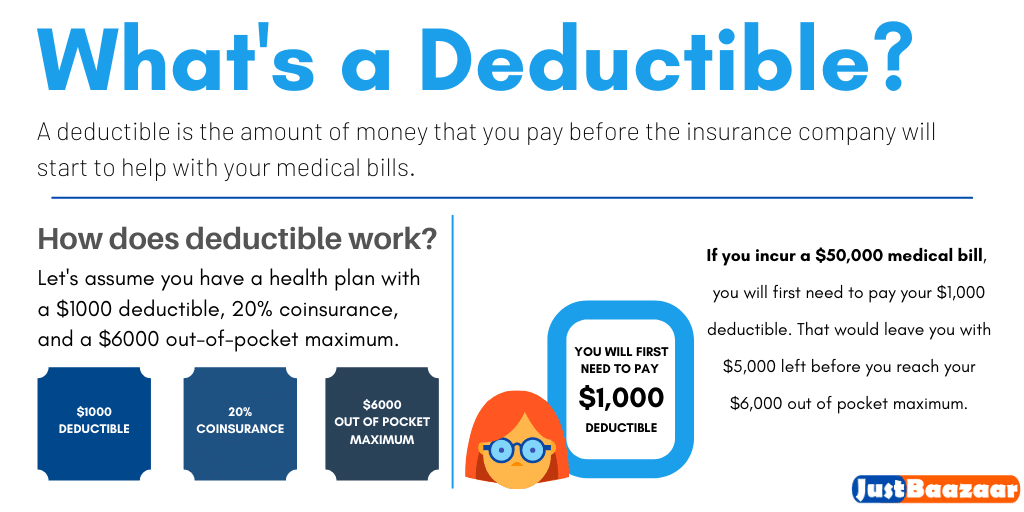

1. What is Insurance Deductible? or What does a deductible mean in health insurance or any other life insurance?

The deductible is the money paid to the insurance company before starting the cover for the cost of your medical expenses. The higher the deductible is the lower the insurance premium is. Deductibles are created to share the cost of care. The deductible is reset every year.

Let’s understand the insurance deductible with the example below:

If you have $1000 as a deductible in your insurance policy and you got $5000 on medical proceedings, you need to pay $1000 from your pocket. The remaining amount of $4000 will be taken care of by the insurance company. Still, there are some insurance policies that have Copay or Coinsurance options. For that, you need to study your insurance policy.

Deductible amounts typically range from $500 to $1,500 for an individual and $1,000 to $3,000 for families but can be even higher.

2. How much deductible should I opt for? Shall I have $500 or $1000 as an Insurance Deductible?

The lower the deductible is the higher the coverage is. However, when you opt for a lower insurance deductible, you may have to pay more insurance premiums. In easy words, you have to pay more premiums to have a lower deductible.

3. Why do Insurance policies have deductibles?

Most of the insurance companies want the insured to be involved in the insurance and coverage process. They want you to share the cost of the claims. Deductibles also provide relief in case of catastrophic, natural calamities, etc. Deductibles are also there to ensure that insured is behaving in good faith.

If there is no deductible, the insured party may get engaged in risky behaviour and will not care about the financial consequences.

4. Deductible vs Copy and Coinsurance

Understanding Insurance is not easy for laymen. Even I did great research before coming with this post. However, it is strongly advised to understand your insurance policy beforehand.

5. Copay or Copayment plan means you have a specified percentage assigned to pay each time you visit a doctor or for any other medical expenses which are covered in your insurance policy. The copay amount is clearly mentioned in the Health Plan ID Card. Not always you have to Copay. It entirely depends on the type of insurance you have opted for or going to opt for. I would say, try to avoid Copay by paying a little extra premium if you have the option to do so.

6. How does Insurance Deductible work?

As mentioned above, If you have $1000 as a deductible in your insurance policy and you got $5000 on medical proceedings, you need to pay $1000 from your pocket. The remaining amount of $4000 will be taken care of by the insurance company. Still, there are some insurance policies that have Copay or Coinsurance options. For that, you need to study your insurance policy.

7. Do we pay a deductible every time?

Yes, you have to pay it every time and every year. However, some plans do not have a deductible. If you do not want to pay the deductible, you can go for a 100% Coverage Insurance policy.

8. Do you want a high or low deductible?

It is you who can understand it better. You need to study, understand various aspects of your life, family, and financial conditions before reaching a conclusion. As mentioned above, The lower the deductible is the higher the coverage is. However, when you opt for a lower insurance deductible, you may have to pay more insurance premiums. In easy words, you have to pay more premiums to have a lower deductible.

9. What is a good Deductible for insurance?

Good Deductible extends to $1400 for an individual and up to $2780 for a family plan.

10. What happens if you do not meet your deductible?

You will not get benefits from many health plans if you do not meet your insurance deductible. The insurance deductible can be $1000, $2000, or even more. There are a few benefits that are still applicable when you are not meeting your insurance deductible?

11. Do we have to pay the deductible up front?

A health insurance deductible is a specified amount or capped limit you must pay first before your insurance will begin paying your medical costs. For example, if you have a $1000 deductible, you must first pay $1000 out of your pocket before your insurance will cover any of the expenses from a medical visit.

12. What is the downside of having a high deductible?

Every time you incur medical expenses, you have to pay your deductible. In case you have opted for a higher deductible, you have to pay the same every time. That’s why at the time of taking a policy make sure you are able to lower the deductible as per your best capacity. The lower the deductible is the higher the premiums are.

13. What is a 1% Deductible?

It’s a percentage of your home’s insured value. These deductibles are typically between 1 – 10% of that value. So, if your home is insured for $300,000 and your deductible is 1%, you would pay $3,000 out of pocket. If you made a claim for $10,000, your insurance would cover $7,000

14. How can we avoid paying car insurance deductible?

Do not file a claim unless you have the money to pay for the deductible.

Check your insurance policy as you may not have to pay deductible upfront

You can coordinate with your mechanic and work out a deal

You can go for a loan

15. Is it better to have a high deductible health plan?

As mentioned above, If you have $1000 as a deductible in your insurance policy and you got $5000 on medical proceedings, you need to pay $1000 from your pocket. The remaining amount of $4000 will be taken care of by the insurance company. Still, there are some insurance policies that have Copay or Coinsurance options. For that, you need to study your insurance policy.

16. Can a body shop waive the deductible?

The clear answer is NO. There is no way ethically to getting your deductible waived off by a body shop. The only seems feasible in this matter is trade-offs or some manipulations in the final bill by the auto Body Shop. The best option here is not to seek a deductible waive off from the Auto Body Shop. Also, you may end up going to Jail if you insist to get the deductible waived off. So, be wise here.

17. Will we get our deductible back?

You only get your deductible back when it is found that you were not at the fault. The insurance companies along with authorities determine who is at the fault.

18. Do I have to pay my deductible if I’m not at fault?

Yes, Initially you have to pay. However, as mentioned above, you will get it back when you are found not at fault.

Related Posts:

- Car Insurance Quotes

- Best Insurance Companies in the USA

- What is Insurance?

- Term Insurance

- Best Car Insurance Quotes

- Importance of Health Insurance

- Why should you take Insurance?

- Who is the policyholder in auto insurance?

- Car Insurance

For Your Reference, Some of the Best Insurance Companies are mentioned below

[jobs location=usa keywords=insurance]

This page is maintained by Suniltams.